Managing Expenses

Expenses are divided into separate stages of the Commercial Real Estate Lifecycle:

- Acquisition

- Development

- Financing

- Operating

- Selling

Click an expense type on the sidebar to expand that Expense Type and choose whether to Create, Edit, or View those expenses.

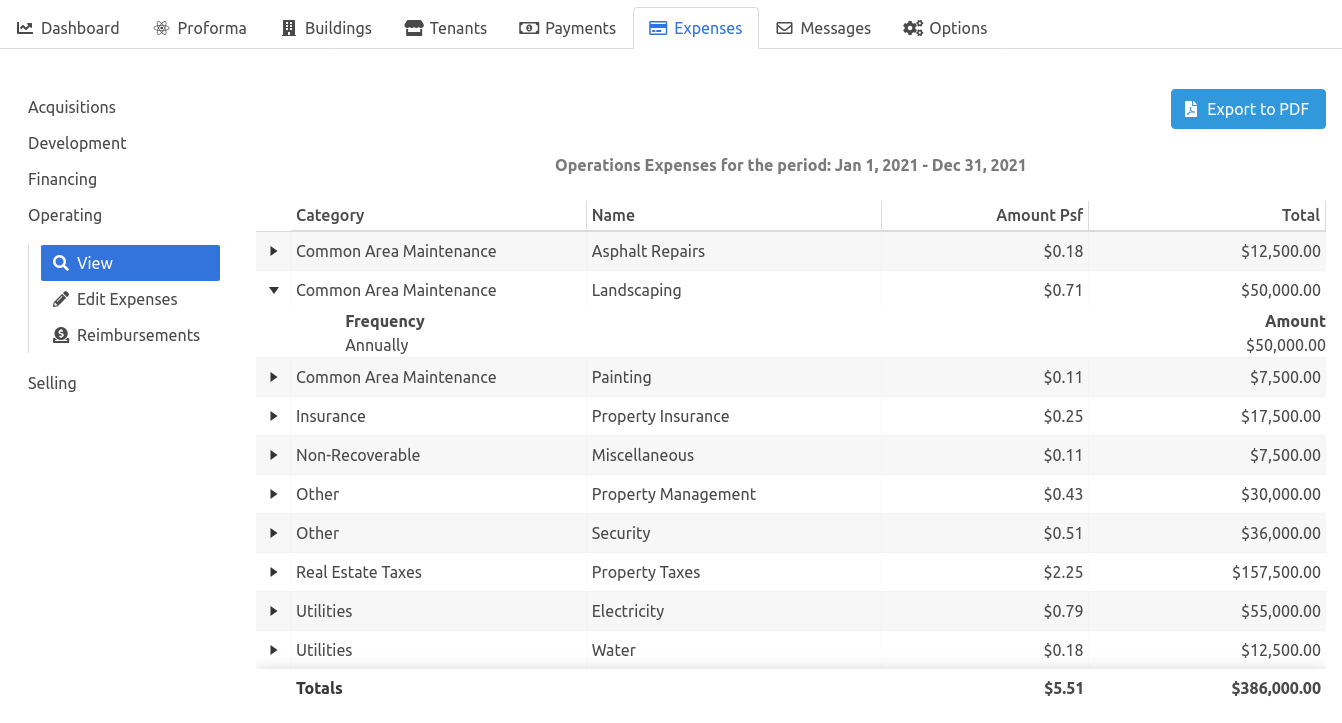

View Expenses#

Expenses are displayed and calculated over the Proforma Period dates. Click the down-arrow on any expense to see more detailed information such as timing and payment frequency.

Create and Edit Expenses#

Expenses are grouped based on type and category. Once an expense type (Development, Operating, etc.) has been selected, new expenses are placed into a category within that type.

To add expenses, first create an expense category and then add expense line items to the category.

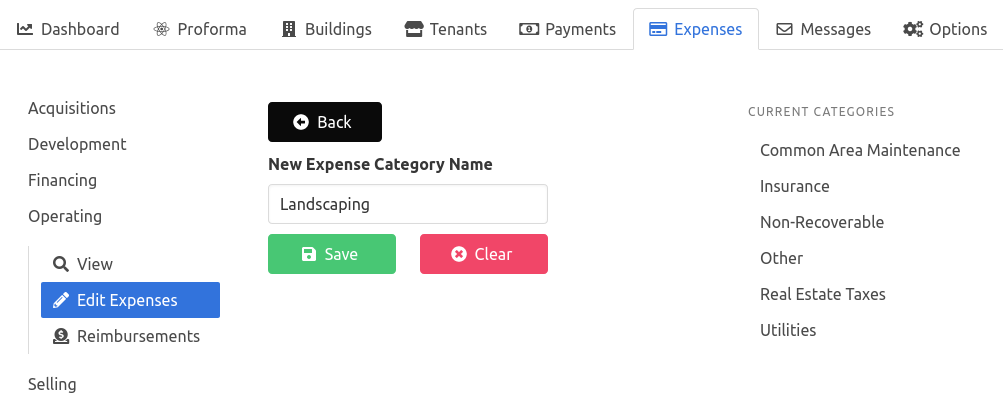

Expense Categories#

Expense categories are used to aggregate similar expenses at the property.

Any expense category that contains line items appears on the Proforma.

To create an expense category:

- Click "New Category"

- Enter an Expense Category Name

- Click "Save"

note

Existing categories are listed on the side as a reference. There are five expense categories are created by default for Operating Expenses:

- Common Area Maintenance

- Insurance

- Real Estate Taxes

- Other

- Non-Recoverable

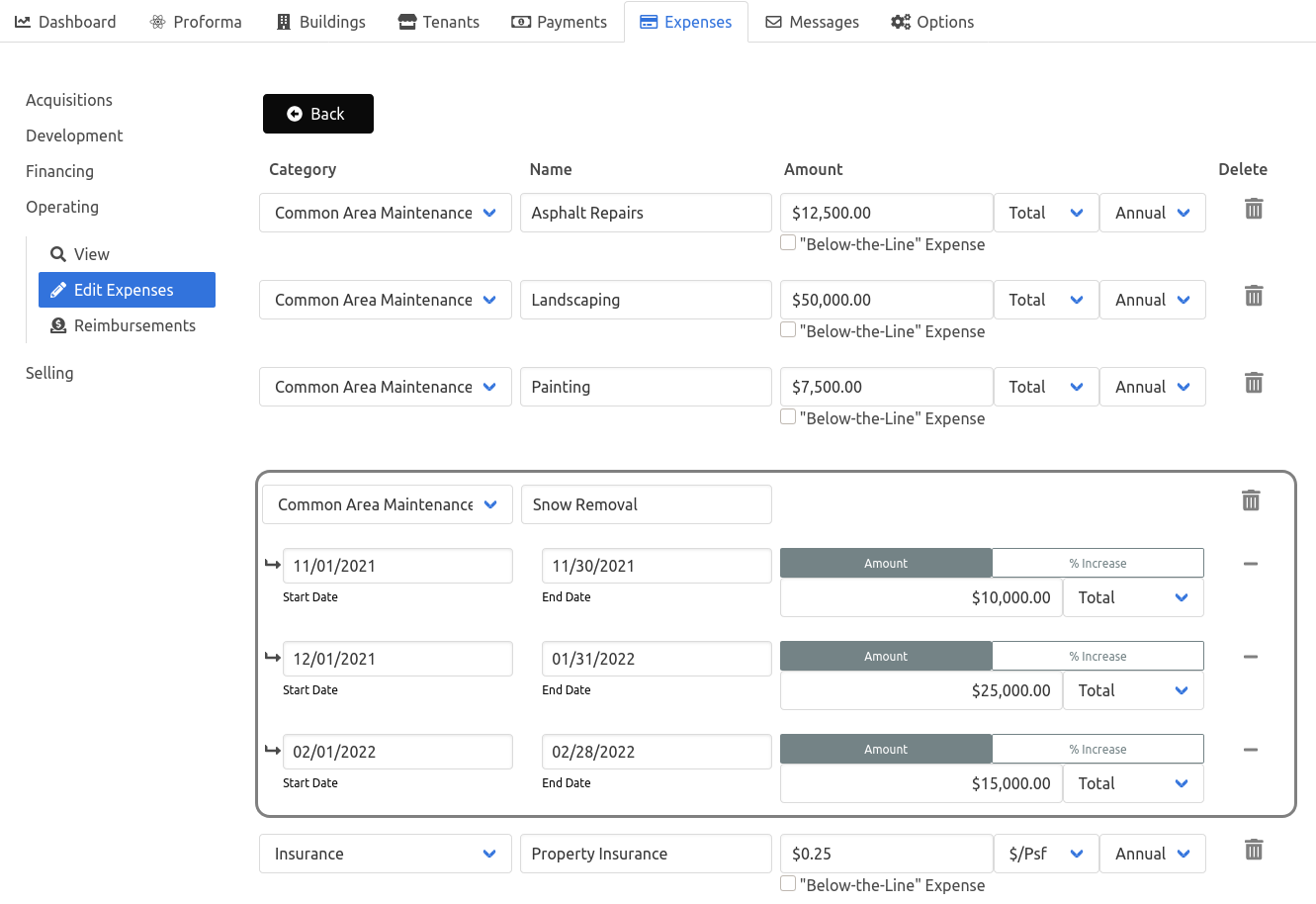

Expense Line Items#

After creating a category, line items (individual expenses) are added by selecting "New Expense".

To create an expense line item:

- Click "New Expense"

- Enter the following information:

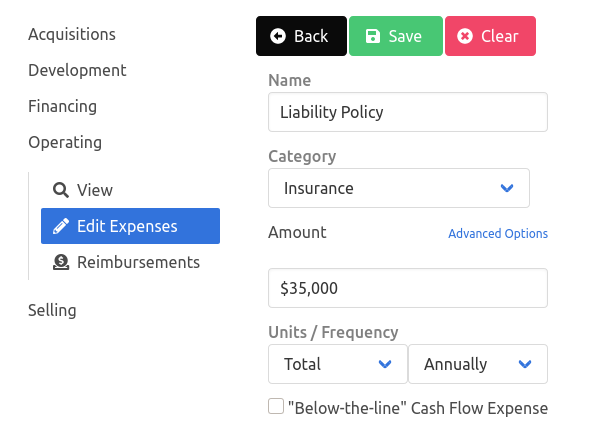

- Name

- Category

- Amount - An expense can be either "Basic" or "Advanced".

- Basic - The amount entered is assumed to be an annual expense, incurred equally each month over the Proforma Period

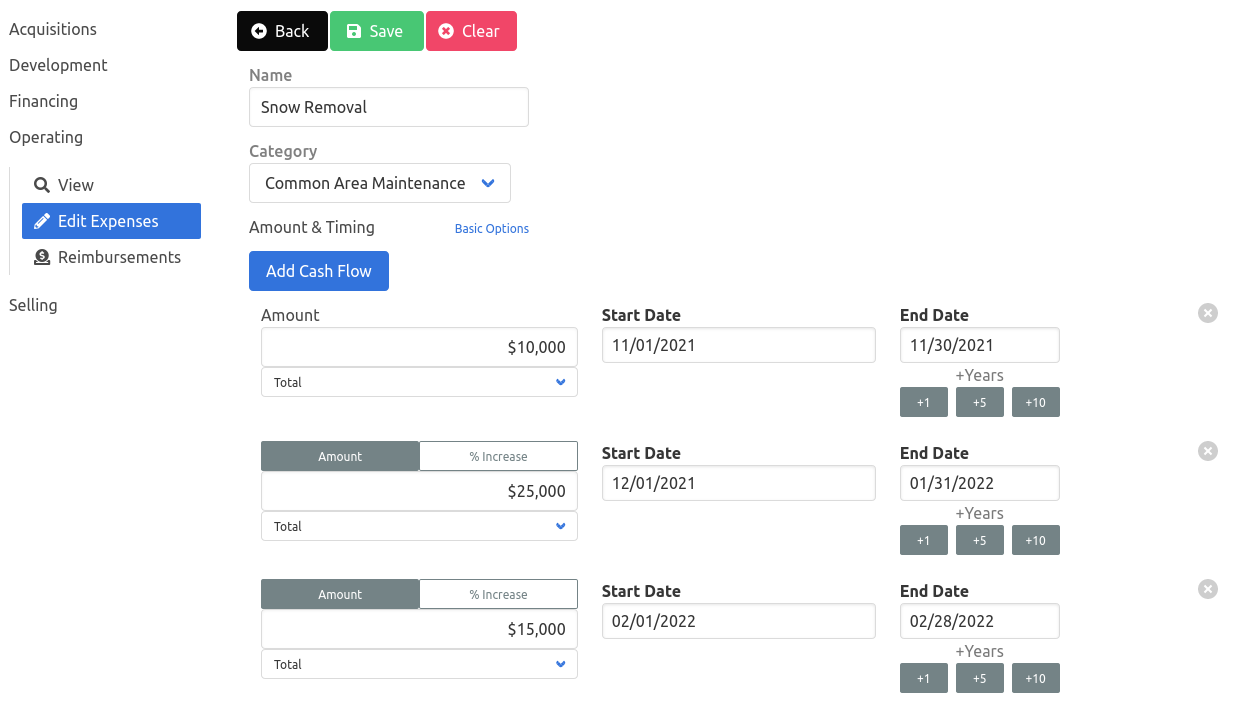

- Advanced - Allows control over the expense amount and timing. Select "Advanced Options" to specify the amounts and dates.

- Expense Amount

- Input as either a total amount or a % increase over the previous period's amount.

- Expense Start Date

- Expense End Date

- Expense Amount

- Basic - The amount entered is assumed to be an annual expense, incurred equally each month over the Proforma Period

- Units/Frequency

- Units accepts "Total", dollars per square foot ($/psf), or dollars per square meter ($/psm).

- Frequency

- Options include Annually, Quarterly, or Monthly.

- "Below-the-line" Cash Flow Expense

- This option is to indicate an unusual or other non-operational expense. Expenses marked as "Below-the-line" are deducted after Net Operating Income to determine the Property's Net Cash Flow.

- A common type of "Below-the-line" expense is the Interest Expense due for a loan.

note

Basic Expenses are assumed to be an annual amount, incurred monthly over the Proforma Period entered, therefore if an expense is entered as:

- Amount: $10,000

- Unit: Total

- Frequency: Monthly

The calculated expense for the proforma period is $10,000 * 12 = $120,000.

Accordingly, the same expense paid quarterly is calculated as $10,000 * 4 = $40,000.

If the proforma period is longer than a year, 16 months for example, this expense would now be $10,000 * 16 = $160,000.

Modifying Expense Line Items#

Expense Line Items are edited by selecting "Edit Expenses".

To alter a field, click on the field and enter the new name, amount, date, etc. Re-categorize an expense by selecting a new expense category from the dropdown.

To delete an expense, click on the trashcan next to the line item.

To delete a cash flow from an Advanced expense, click on the minus icon to remove the selected cash flow.

Once the expenses have been updated, click "Save Changes" to update the expenses, or "Discard Edits" to undo any changes.

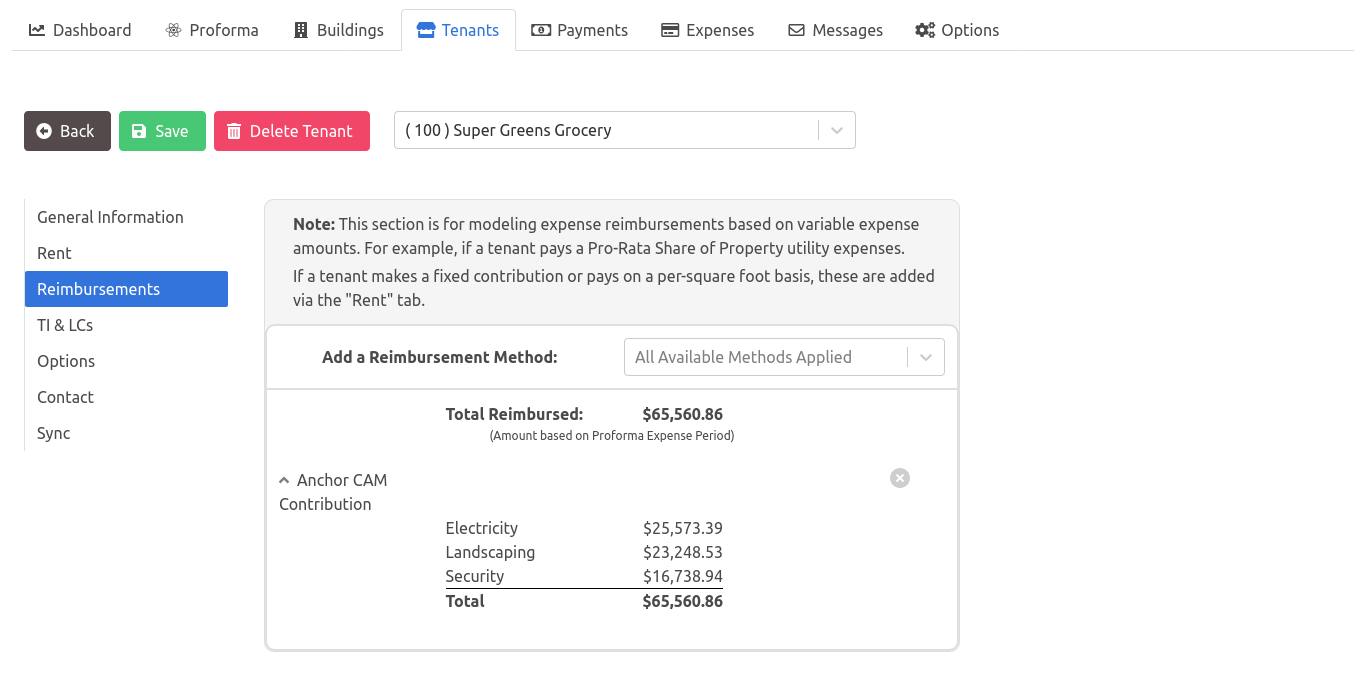

Reimbursements#

Reimbursement of expenses, for example by Tenants on a Pro-Rata basis, are modeled in this section. If a Tenant makes a fixed contribution, such as $3.50 per square foot towards Common Area Maintenance, it should be entered via the Tenant's rent tab.

Reimbursements require tenants to be assigned a Reimbursement Method, which includes any number of Reimbursement Rules. Each rule represents a calculation to apply to a specific expense or group of expenses.

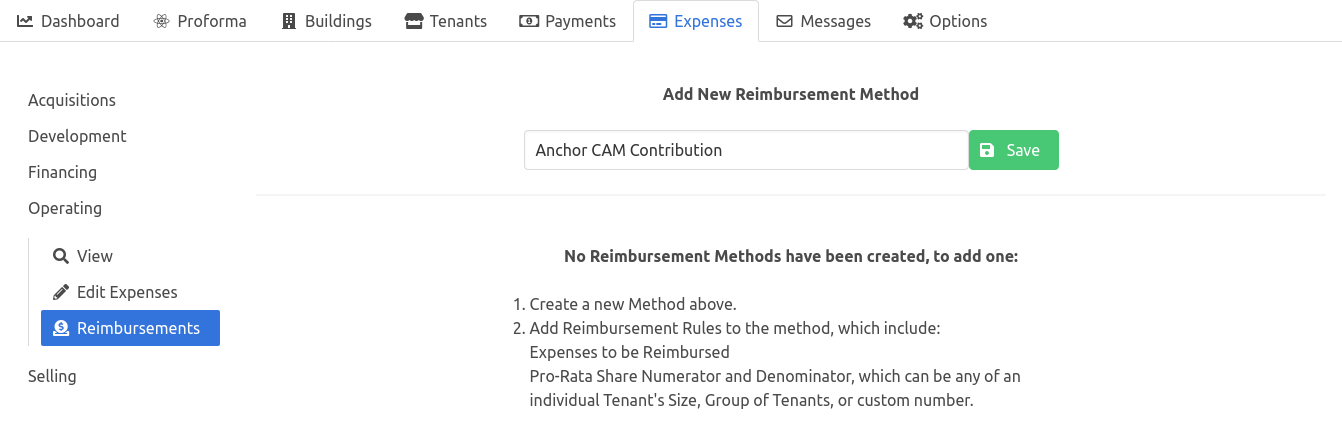

Create a reimbursement:#

Create a Reimbursement Method

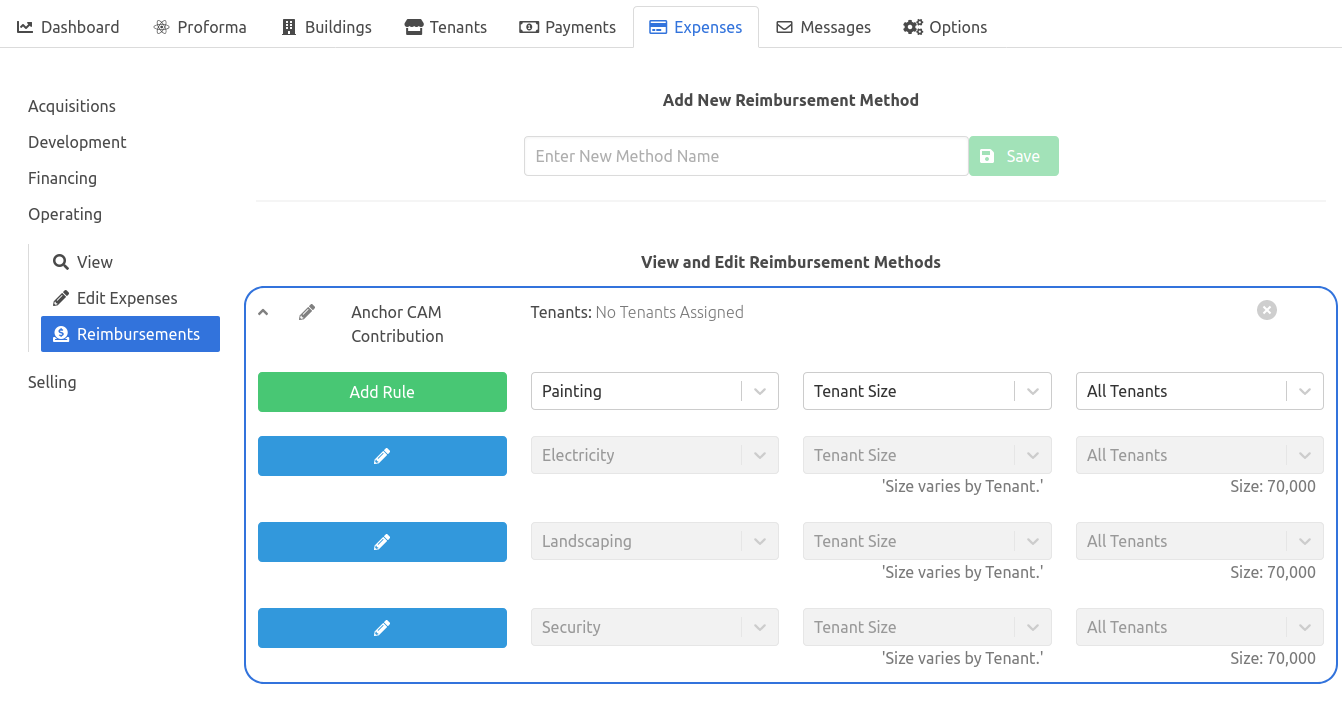

Click on the down-arrow to expand a Reimbursement Method.

Enter the following information regarding the expense to reimburse:

- Expense

- The expense line item or expense group to be reimbursed

- Numerator

- Select either Tenant Size, Tenant Group, Building Group, Building, or a specific Tenant.

- Denominator

- Select either Tenant Size, Tenant Group, Building Group, Building, or a specific Tenant.

- Expense

Click "Add Rule" to save the Reimbursement Rule.

note

Tenant Size will take the size of the Tenant the Reimbursement Method is assigned to. For example, if Tenant A is 30,000 square feet and Tenant B is 5,000 square feet - the calculation will use 30,000 square feet for Tenant A and 5,000 square feet for Tenant B.

Assigning Reimbursements to Tenants#

Once a Reimbursement Method is created, it can be assigned to a Tenant. Reimbursement Methods assigned to Tenants are included in the Proforma and other Reports.

- Navigate to Reimbursements in the Tenants tab.

- Select which Reimbursement Methods to apply from the dropdown menu next to "Add a Reimbursement Method". Multiple Reimbursement Methods can be applied to a tenant, and each Method may only be applied once.

- Click "Save".

To remove a Reimbursement Method, click the "x" on the method to remove.