Understanding the Proforma

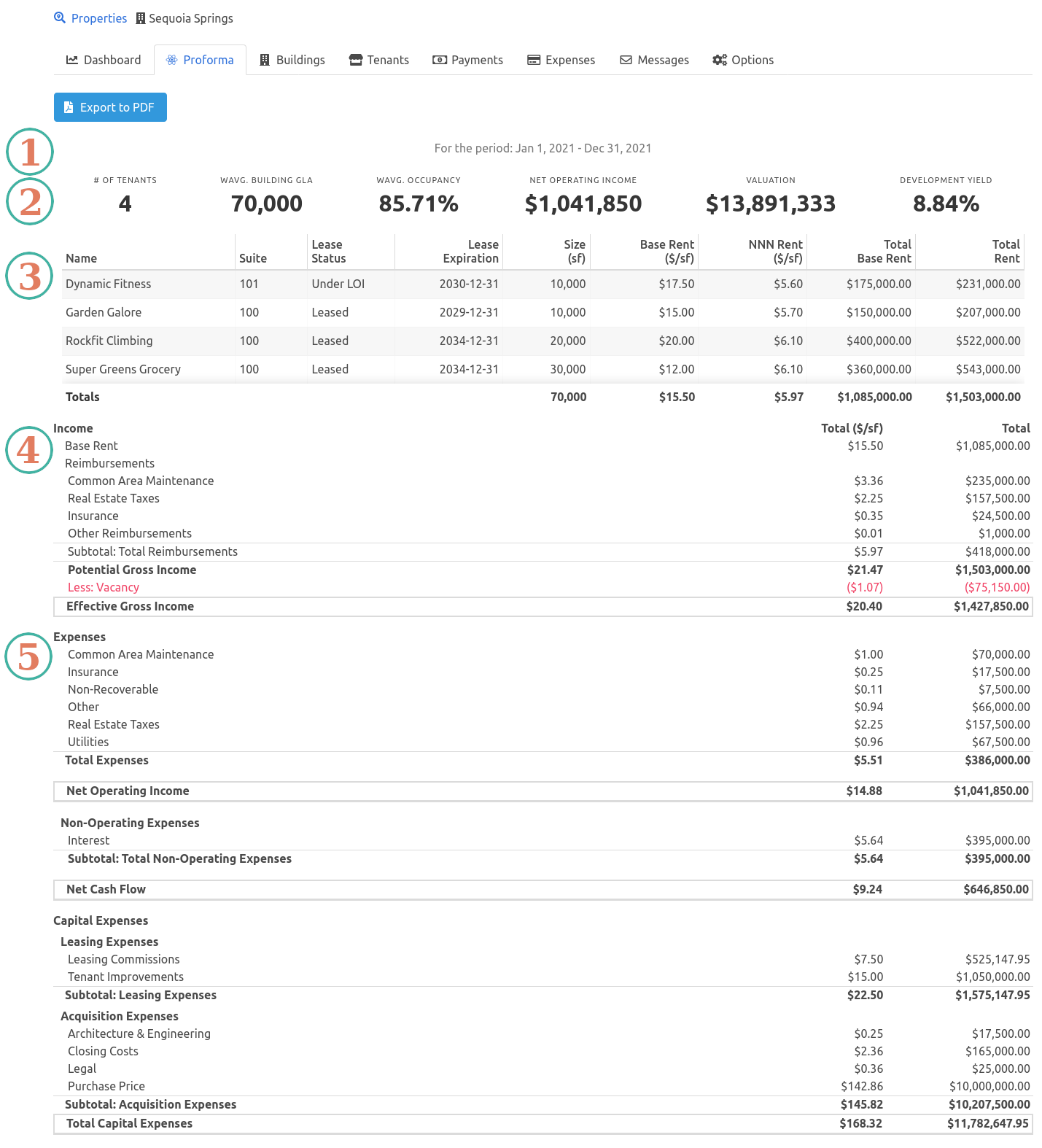

The Proforma is a snapshot of your Property's financial performance over a chosen period of time.

There are five primary sections:

- Time Period - The time period covered by the Proforma.

- Summary - Key Property Performance Indicators.

- Tenants - Rent details of included tenants.

- Income - Revenue generated by Operations during the selected time period.

- Expenses - Expenses incurred operating the property during the selected time period.

1. Time Period#

The time period determines which Tenants and Expenses are included in the proforma.

These dates can be updated through the Proforma Dates menu inside the Options tab.

2. Summary#

The Proforma Summary includes the following Property Performance Indicators:

# Of Tenants#

Number of Tenants included in the Proforma during the period. All tenant statuses are included (Leased, Available, Negotiating, etc.).

Wavg. Building GLA#

Wavg. Building GLA that is available to be leased during the period, weighted by how many days the building was Complete / On-line over the period.

note

The Wavg. Building GLA is the summation of the below calculation, for all buildings:

Wavg. Building GLA =

Building Square Feet x Building's Days Online / Days in Proforma Period

- A 30,000 square foot building comes online at exactly the middle point of the time period, it contributes 15,000 square feet to the Wavg. Building GLA.

- A 30,000 square foot building was completed prior to the proforma period beginning, it contributes 30,000 square feet to the Wavg. Building GLA.

- A 30,000 square foot building is completed after the proforma period, it contributes 0 square feet to the Wavg. Building GLA.

Wavg. Occupancy#

Wavg. Occupancy is the percentage of the Gross Leasable Area occupied during the period. This only includes Tenants with a Leased status.

note

To calculate Wavg. Occupancy, each Tenant's Wavg. Leased Area is first calculated:

Tenant Wavg. Leased Area =

Tenant Size x Days Leased In Period / Days in Proforma Period

This is repeated for each tenant, and when added together is the Total Wavg. Leased Area for the period.

The Total Wavg. Leased Area is then divided by the Wavg. Building GLA to arrive at the Wavg. Occupancy.

Wavg. Occupancy =

Total Wavg. Leased Area / Wavg. Building GLA

- A lease with a Tenant occupying 5,000 square feet starts at exactly the middle point of the time period, it contributes 2,500 square feet to the Tenant Wavg. Leased Area, increasing the Wavg. Occupancy.

- A lease with a Tenant occupying 5,000 square feet begins after the proforma period ends, it contributes 0 square feet to the Tenant Wavg. Leased Area and does not increase the Wavg. Occupancy.

Net Operating Income#

Net Operating Income is the profit generated through Operations. Net Operating Income includes all regular, recurring revenues and expenses from operations. One-time and irregular revenues, charges and capital expenses should not be included.

Net Operating Income includes a reserve of 5% of Tenant Income to account for any vacancy, collection, or credit concerns. Credit and Vacancy Loss Assumptions can be updated through the Credit / Vacancy Loss menu inside the Options tab.

If there are any Non-Operating or other "Below-the-line" expenses, these are subtracted from Net Operating Income to calculate the property's Net Cash Flow.

note

To calculate Net Operating Income, the Property's Effective Gross Income is first calculated:

Effective Gross Income = Potential Gross Income - Vacancy Loss/Reserve

Then, the Net Operating Income can be calculated as follows:

Net Operating Income = Effective Gross Income - Total Operating Expenses

And if there are any "Below-the-line" expenses:

Net Cash Flow = Net Operating Income - Non-Operating Expenses

Valuation#

Simple Asset Manager uses the Capitalization method to value each property. This requires two inputs, the Net Operating Income and a Capitalization Rate (also known as the Cap Rate). The Capitalization Rate can be updated through the Cap Rate menu inside the Options tab.

note

The Valuation is calculated as follows:

Valuation = Net Operating Income / Capitalization Rate

Development Yield#

Development Yield is the current return on the Property, and a useful metric to benchmark the property's performance against other investments.

note

Development Yield is calculated as follows:

Development Yield = Net Operating Income / Total Capital Expenses

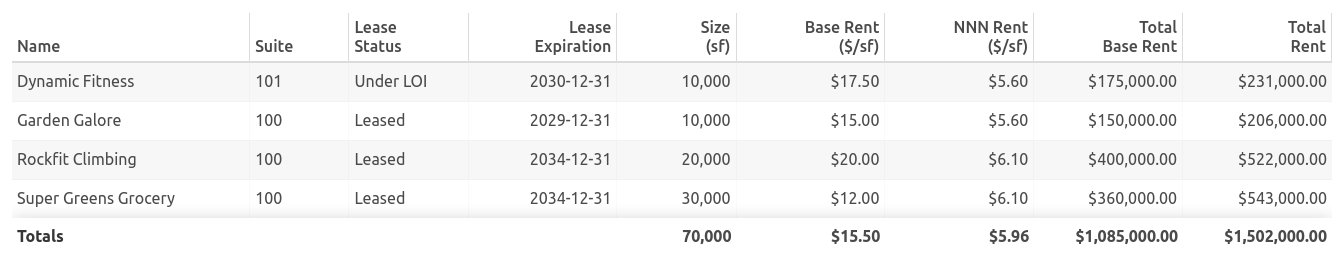

3. Tenants#

The Tenants table reflects information entered via the Tenants tab. All tenants with start dates or end dates within the proforma period are included.

important

The Proforma includes Tenants with any status - Available, Interested, Leased, Negotiating, and Under LOI.

This table includes the follow tenant information:

- Name

- Suite

- Lease Status

- Lease Expiration

- Size

- Base Rent

- NNN Rent - Includes income from Rent and Reimbursements

- Total Base Rent

- Total Rent - The sum of Base Rent + NNN Rent

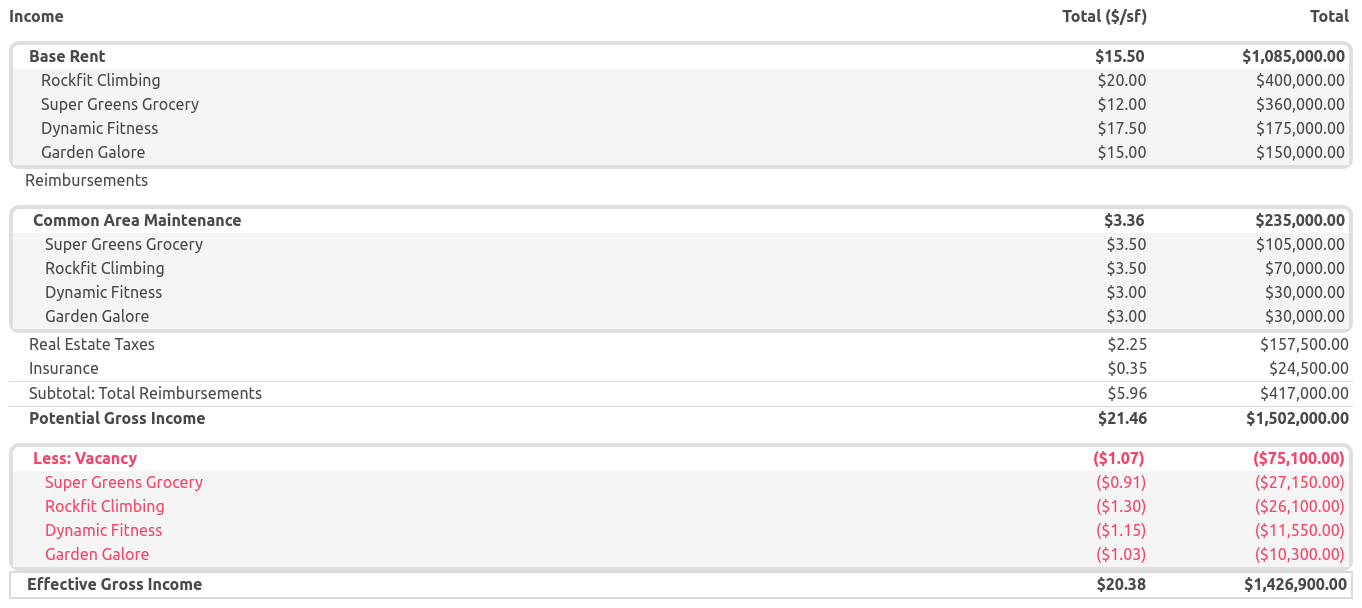

4. Income#

Potential Gross Income is the sum of all rental and reimbursement income at the property, assuming it is 100% occupied and all rent is collected. To account for any vacancy, credit, and collection issues - a vacancy and credit reserve is subtracted from Potential Gross Income to arrive at the property's Effective Gross Income.

note

Click on any category in the proforma to expand the selected category and display the individual items. Click the category again to collapse it back to a single line.

Base Rent#

Includes Base Rent entered in the Tenants tab.

Reimbursements#

- Includes Common Area Maintenance, Real Estate Taxes, Insurance, and Other Rent entered in the Rent section of the Tenants tab.

- Includes all reimbursements modeled in the Reimbursements section of the Tenants tab.

Vacancy & Credit Loss#

Vacancy & Credit Loss is a reserve to account for frictional vacancies at the property and failure to collect rent. The default vacancy and credit reserve is 5% and can be modified per tenant. Vacancy & Credit Loss assumptions are updated through the Options tab.

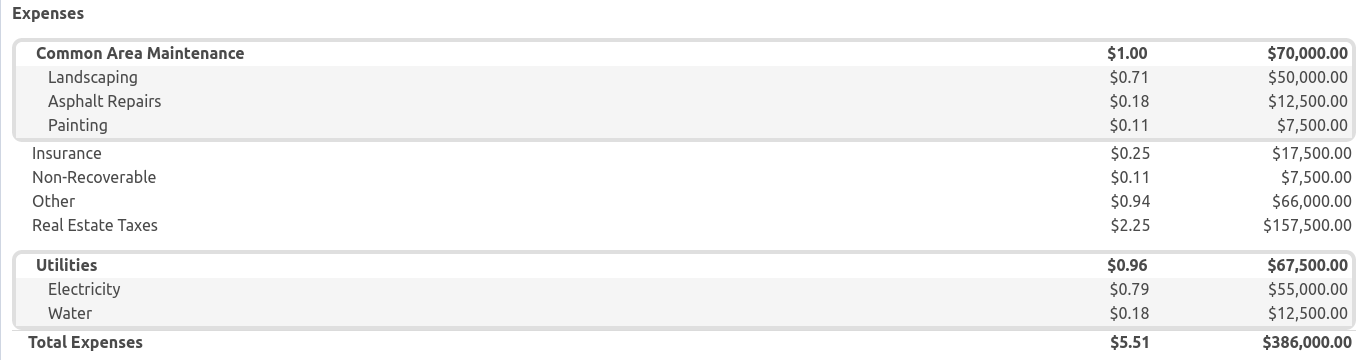

5. Expenses#

An expense can either be Operating (impacts Net Operating Income) or a Capital Expense (does not impact Net Operating Income).

Expenses that are entered with custom timing are included if the expense occurs within the selected proforma period. Expenses without a custom timing are assumed to be an annual expense that is incurred equally each month. For example, a $120,000 annual expense is represented as a $10,000 expense each month.

If there are Non-Operating expenses that affect cash flow, such as Interest Payments, these may be categorized as a "Below-the-line" expense. Below-the-line expenses are subtracted from Net Operating Income to determine Net Cash Flow.

note

To view the line items within an expense category, click on the category to expand the selected category. Click on the category again it collapse it and hide the individual line items.

Operating Expenses#

Operating Expenses include all expenses entered in the Operations category in the Expenses tab. Each Expense Category and it's line items appear in this section.

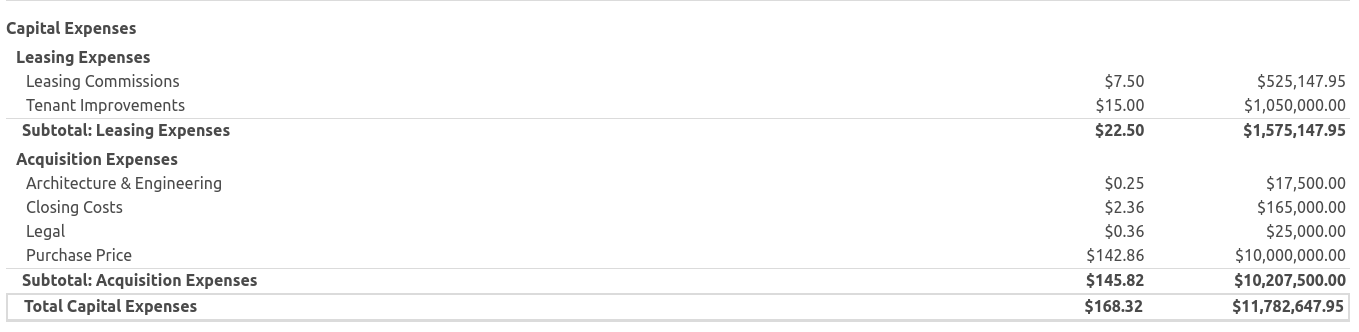

Capital Expenses#

Capital Expenses include Acquisition, Financing, Development, Leasing, and Selling Expenses associated with the property. These expenses are entered in their respective category in the Expenses tab.

The exception to this is Leasing Expenses, which are entered per tenant in the TIs and LCs section of the Tenants tab.